Ethanol Market Overview

The Central Government is focussed on reducing the country’s dependence on imported crude oil while reducing the environmental impact of the pollution/emissions. In order to achieve this, the Government has been actively promoting the production and blending of fuel ethanol with petrol, and has targeted 20% blending (EBP20) by 2025. EBP20 which was earlier targeted by 2030, was advanced recently, which reaffirms the Government’s focus and commitment.

The blending programme brings several benefits, such as, increase in domestic energy production leading to increase in energy security; reduction of oil import bill, thereby saving foreign exchange; to address structural problems in sugar industry and provide remunerative income to farmers; make use of damaged and surplus grains; and address environmental concerns.

Ethanol Demand Drivers

With population growth and increasing urbanisation pushing the need for mobility, India’s transportation sector is growing rapidly, causing dependence on oil to also concurrently rise. Considering the burgeoning oil import bill and the growing concern for the environment, there is a need to adopt non-conventional fuels.

Ethanol, being a value-added product from molasses – a co-product in the manufacture of sugar from sugarcane – benefits sugarcane farmers across the country.

The key drivers for the Ethanol Industry are:

Ethanol Demand-Supply Scenario

For the marketing year 2019-20 (December 2019 to November 2020), the Oil Marketing Companies (OMCs) estimated the requirement at 511 crore litres against which only ~ 195 crore litres were contracted and only 89% of the same was supplied. This resulted in an overall blending of 5% across the country. Around 770 million litres have been produced from B-heavy molasses and sugarcane juice, leading to a reduced production of sugar to the extent of 8,00,000 tonnes.

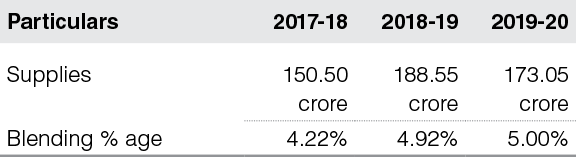

The ethanol blending programme for the past three years has been as under:

Comparative Supplies (for marketing year – Dec – Nov)

For the Marketing Year 2020-21, Oil Marketing Companies (OMCs) have issued a tender for 457.6 crore litres against which contracts were finalised for 348 crore litres. Of the total ethanol contracted, 12% quantity is from sugarcane juice and 13% quantity is from damaged foodgrains and surplus rice etc.

The OMCs issued the total Letter of Intent (LOI) quantity of 348 crore litres, during the current marketing year and contracted 326.10 crore litres and 169.4 crore litres of ethanol have been supplied as on June 24, 2021. About 77% of the total supply so far comprises of ethanol made from sugarcane juice/B-Heavy molasses. The country, on an average, achieved a blending percentage of 7.79% so far in the current Marketing Year 2020-21, resulting in almost 8-10% blending is in most of the states except Rajasthan, Kerala, West Bengal, Assam, NE states, Kashmir and Ladakh.

The Central Government announced the revised prices for ethanol for the season starting from Dec 2020 to Nov 2021: Ethanol from C-heavy molasses - ₹ 45.69/litre (+ ₹ 1.94/litre), Ethanol from B-heavy molasses - ₹ 57.61/litre (+ ₹ 3.34/litre) and Ethanol from sugarcane juice - ₹ 62.65/litre (+ ₹ 3.17/litre).

The Government is targeting to achieve 20% blending of Ethanol by 2025 which would largely solve the problem of excess sugar, relieve sugar industry from the problem of storage of surplus sugar, and also improve the revenue realisation of sugar mills leading to timely payment of sugarcane dues of sugarcane farmers. EBP 20 is estimated to consume 6 million tonnes of surplus sugar which will lead to stable sugar prices as a result of matching of production with consumption.

Under the WTO norms, the Government cannot provide any assistance for sugar exports from 2023 onwards. In order to manage the demand-supply of sugar in the country after 2023, the Central Government is planning an investment to the tune of ₹ 41,000 crore to achieve the incremental ethanol production capacity.

There is a need of 1,016 crore litres of ethanol in order to achieve 20% blending in the country along with a higher installed capacity of 1,350 crore litres as sugar companies use part of ethanol for producing alcohol by fermenting it with grains, fruits or vegetables.

Government Policies

The various policy initiatives undertaken by the Indian Government for ethanol blending, over the years, include:

Historically, there have been notable interventions by the Government in this area such as the National Biofuel Policy, announced in 2018 for accelerated development and utilisation of biofuels in view of the direct and indirect subsidies to fossil fuels and distortions in energy pricing.

The Policy categorised biofuels as:

- “Basic Biofuels” - First Generation (1G) bioethanol and biodiesel

- “Advanced Biofuels” - Second Generation (2G) ethanol, Municipal Solid Waste (MSW) to drop-in fuels

- Third Generation (3G) Biofuels, Bio-CNG etc.

The Policy expanded the scope of raw material for ethanol production by allowing use of sugarcane juice, sugar containing materials like sugar beet, sweet sorghum, starch containing materials like corn, cassava, as well as damaged food grains like wheat, broken rice, rotten potatoes that are unfit for human consumption, for ethanol production.

The recent Government initiatives are given below:

- The Central Government, announced the revised prices for ethanol for the season starting from Dec 2020 to Nov 2021 whereby the ethanol from C molasses will realise ₹ 45.69/litre, an increase of ₹ 1.94/litre and the ethanol from B-heavy molasses will realise ₹ 57.61/litre an increase of ₹ 3.34/litre. The realisation from Sugarcane juice has been revised upward by ₹ 3.17/litre at ₹ 62.65/litre. This auger well for the sugar industry.

- The Central Government also announced a modified scheme for extending financial assistance by way of interest subvention for five years (on the loan availed from banks), @ 6% per annum or 50% of the rate of interest charged by banks whichever is lower, to incentivise enhancement of ethanol distillation capacity or to set up new distilleries for producing 1st Generation (1G) ethanol from feed stocks sugar beet, sweet sorghum, cereals etc. or converting molasses-based distilleries to dual feedstock. It is the step in the right direction to manage with the surplus sugar production in the country and to effectively utilise damaged and surplus grains. This is expected to bring an investment of about ₹ 40,000 crore.

- The Government has also fixed remunerative prices of ethanol derived from various feedstocks.

- Moreover, OMCs, being the assured buyer for ethanol, had issued tender in October 2020 for ethanol procurement for 2020-21 wherein they have indicated yearly quantity off- take for the next 5 years. The medium term off-take visibility provided by the OMCs helps the sugar industry to plan its capex programme as there is more clarity in terms of off-take of ethanol over a longer period.

- The Government is now targeting to achieve 20% blending of Ethanol by 2025 as against 2030 earlier, which would largely solve the problem of excess sugar, relieve sugar industry from the problem of storage of surplus sugar and also improve the revenue realization of sugar mills leading to timely payment of sugarcane dues of sugarcane farmers.

Our Facilities

The Company’s Alcohol business presently comprises two distilleries with aggregate capacity of 320 Kilo Litre per Day (KLPD) – a) 160 KLPD at Muzaffarnagar district is a standalone distillery located between two large capacities sugar units, b) 160 KLPD distillery is located at Sabitgarh, district Bulandshahar, at one of the sugar units.

The Company plans to enhance the total distillation capacity to 660 KLPD before the commencement of the sugar season 2022-23, with expansion of existing distilleries and two new plants in the pipeline. The first is a new distillery being set up at our Milak Narayanpur sugar mill, which will be operated on molasses/sugarcane juice/syrup & grain. The second is a new grain-based distillery, being set up at Muzaffarnagar.

The existing distilleries are among the largest single stream molasses-based distilleries in India. These distilleries have assured access to consistent supply of captive raw material (molasses) – C as well as B-heavy molasses, sugarcane juice/syrup. In the upcoming distilleries, there would be flexibility to operate with dual feedstock as per the Government of India’s Biofuel policy based on economics and availability.

The distillery at Muzaffarnagar has a flexible manufacturing process, allowing it to produce high quality Extra Neutral Alcohol (ENA), Rectified Spirit (RS), Specially Denatured Spirit (SDS) and Ethanol, based on the market dynamics and requirements, whereas the distillery at Sabitgarh is designed to produce only ethanol. The distilleries have been mainly producing ethanol over the last few years for supplying to Oil Marketing Companies (OMCs) for blending in petrol.

In line with the new directives and guidelines of the Government of India regarding effluent treatment and to ensure Zero Liquid Discharge (ZLD), all the distilleries of the Company are based on concentrated spent wash (termed as SLOP) fired incineration. The upcoming distilleries would also follow the same route to treat the effluent with ZLD system.

Sanitizer & Indian Made Indian Liquor (IMIL) plants

The Company had set up a modern hand sanitizer production facility at the existing distillery complex at Muzaffarnagar in the first quarter of FY 21. The objective was to cater to acute shortage of sanitizers to combat the spread of COVID-19. This endeavour of the Company ensured regular availability of the sanitizer from this facility to help fight against the pandemic.

Additionally, the Company has in December 2020 set up a IMIL production facility at its existing distillery complex Muzaffarnagar to capture value in respect of molasses, which are required to be sold to IMIL units at a price much lower than the market price of molasses (reserved molasses). As per the present molasses policy, 18% of C-heavy molasses are required to be sold to the IMIL units. Given the opportunity in the growing market of IMIL in UP, the Company decided to leverage the in-house production facility of ENA into quickly entering into the Indian Made Indian Liquor (IMIL) market. Accordingly, by using molasses in the manufacture of IMIL, the Company would reduce its obligation to supply the reserved molasses.

The Company has received an approval to process ENA up to 52.8 lakh litre for manufacture of IMIL and it has plans to increase the capacity up to 3.0 lakh cases per month in phases. The products of the Company were launched in the third quarter of FY 21 and have been well received. The Company would be soon launching the Alco-beverages under multiple brands and would target superior market penetration using attractive packaging.

Other Value Add Products from the Distillery by-Products

At distillery unit located at Sabitgarh, the Company has set up a CO2 Capturing Unit and an Ash Granulation Plant (ash from the incineration boiler is rich in potash content) on Built-Own & Operate (BOO) basis and the same are in operation.

2021 Triveni Engineering, All Rights Reserved

Sugar Business Performance

Sugar Business Performance