Triveni operates seven sugar units spread across the state of UP. Most of the mills are located in Western and Central UP, while one unit is located in Eastern UP. The Company manufactures refined sugar, which constitutes over 40% of the total sugar production and realises a premium over normal crystal sugar realisation. The refined sugar is supplied to high grade end-users, thereby creating a niche customer profile for Triveni. The Company also produces different grades of pharmaceutical sugar that can be customised as per the user requirements and over the past few years, has developed a large customer base for this product also.

The seven sugar units strictly adhere to best-in-class manufacturing processes and quality benchmarks. The Company supplies sugar to major multinational soft drink companies, leading confectionery manufacturers, breweries, pharmaceutical companies, dairies and leading ice cream producers.

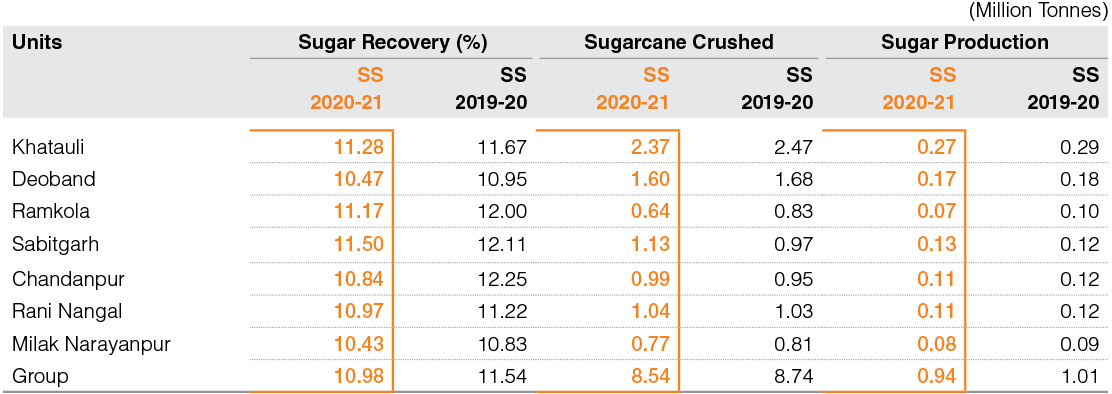

The Sugar business has performed well in FY 21, owing to continuous improvement in reducing the cost of production of sugar, backed by stability in sugar prices. In terms of sugar production in SS 2020-21, the Company has been ranked second in the country with sugarcane crush of 8.54 million tonnes and sugar production of 0.94 million tonne. Khatauli Sugar Mill achieved the highest sugar production in the country as a single unit and second highest sugarcane crush in the country. Two sugar units recorded their highest ever. crush – Sabitgarh & Rani Nangal. Triveni’s focussed sugarcane development programme, with almost 100% high yielding and high sugared variety sugarcane, helped the farmers achieve higher return as a result of high farm productivity while improving the Company’s profitability through higher volume of sugarcane crush and improved recoveries of sugar. The production of over 40% refined sugar, coupled with the high-grade pharmaceutical quality sugar produced by the Company, helps it secure higher realisation. The pharma sugar production, which fetches a substantial premium over refined sugar, has also increased during the current sugar season. Such mix of co-product capacities further helps the Company optimise its overall profitability.

Over and above these factors, the strong financials of the Company and its ability to procure funds at a reasonable cost also contribute in achieving consistent profitability. Consequent to surplus sugar production in the country for several years, one of the biggest challenges for the sugar industry has been to effectively manage its working capital, which has increased significantly due to higher production and limited despatches through monthly quota. The Company has managed sugar inventories well through aggressively engaging in exports under the MAEQ scheme as well as through B-heavy molasses for production of ethanol. The total sugar quota for exports under SS 2020-21 MAEQ scheme is 1.82 lakh tonnes and the entire quota was contracted, of which 1.03 lakh tonnes have been physically despatched in FY 21.

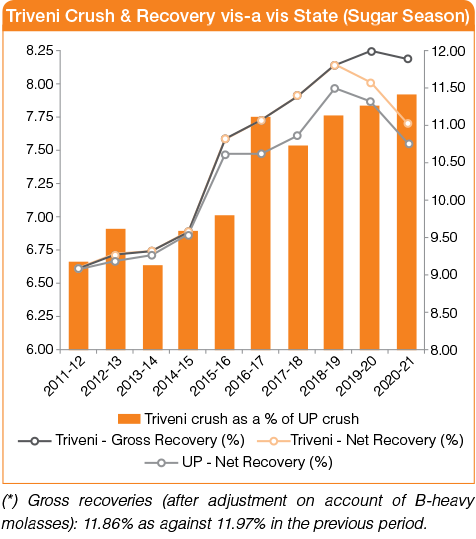

Across UP, there has been a decrease in sugarcane yields and sugar recovery largely attributable to climatic factors as well as due to infestation of crop with disease in certain regions. This resulted in a significantly lower sugarcane availability particularly in eastern UP. Further, the sugarcane crush has reduced due to increased diversion (last year the diversion had been lower due to frequent rainfall & COVID-19 pandemic). The sugar production in the state of UP is around 11.06 million tonnes as on June 30, 2021 down from 12.55 million tonnes last year.

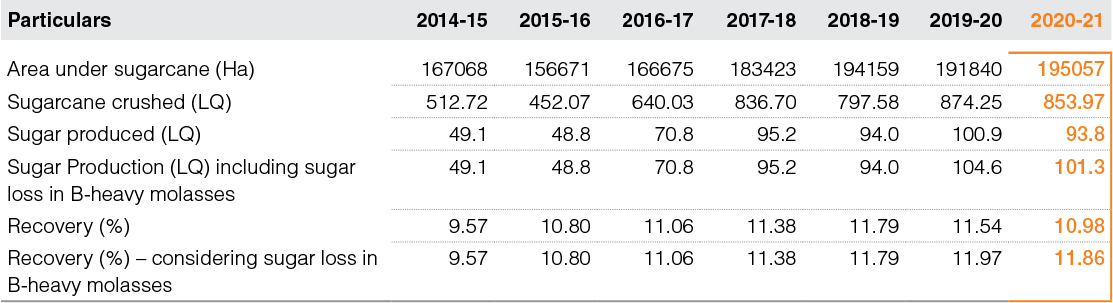

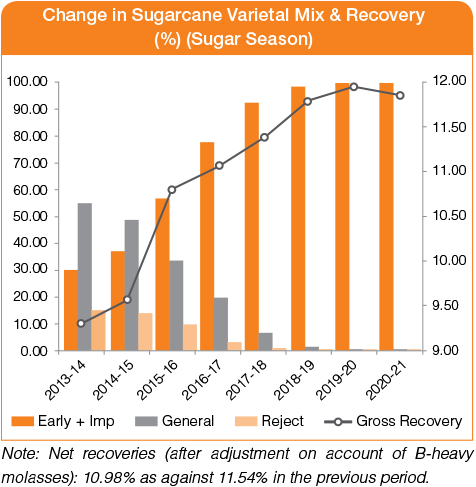

Five sugar units operated with B-heavy molasses diversion in SS 2020-21 (one sugar unit operated for part of the season) as against three units in SS 2019-20. This was done to ensure adequate feedstock (molasses) availability for its distillery units. Consequently, the amount of sugar diversion for the ethanol production has increased this season to 75,148 tonnes as compared to 37,004 tonnes in the previous season. Recovery of 10.98% (Gross Recovery of 11.86% after adjustment on account of B-heavy molasses) recorded in SS 2020-21.

The Company crushed marginally 2.3% lower sugarcane at 8.54 million tonnes as compared to 8.74 million tonnes in the previous season. The decline is mainly due to general trend of lower yields in the state as well as extensive crop damage in Eastern UP due to heavy waterlogging resulting infestation of the crop with disease.

It is important to highlight that though the Company’s sugarcane crush and sugar production during SS 2020-21 is lower than the previous sugar year, it has fared better than the state averages where the decline in crush and sugar production is much higher. For SS 2020-21, the Company’s crush declined by 2.3% as compared to 8.2% decline for the state on an average. The Company’s sugar production declined by 7.0% as compared to 13.0% decline for the state on an average.

The average domestic sugar price realisation for the Company was ₹ 32,703/tonne during the year as against ₹ 33,184/tonne in the previous year. Exports realisation price (excluding subsidy) stood at ₹ 24,381/tonne in FY 21 as against ₹ 19,716/tonne in FY 20.

The average domestic sugar price realisation for the Company was ₹ 32,703/tonne during the year as against ₹ 33,184/tonne in the previous year. Exports realisation price (excluding subsidy) stood at ₹ 24,381/ tonne in FY 21 as against ₹ 19,716/ tonne in FY 20.

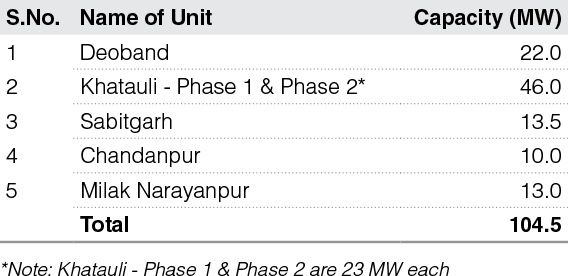

Sugar Business comprises three grid-connected large capacity co-generation plants and three smaller co-generation capacities (incidental co-generation facilities) at its five sugar units, namely Khatauli, Deoband, Chandanpur, Milak Narayanpur and Sabitgarh units. Triveni’s co-generation plants at Khatauli and Deoband utilise highly efficient 87 ata / 515ºC steam cycle to maximise efficient usage of bagasse. After meeting the sugar factory’s captive requirement, as well as the co-generation plant’s auxiliary power requirement, surplus power from these plants is exported to the grid. The Company has power purchase agreements with Uttar Pradesh Power Corporation Ltd. (UPPCL) for all its co-generation facilities.

Unit-wise capacities of the co-generation plants are as follows:

Co-generation operations (including incidental co-generation) exported 2,239 lakh units to the grid during the current year as against 1,831 lakh units in the previous year. Consequently, external sales increased to ₹ 68.35 crore in the current year from ₹ 54.16 crore in the previous year, a growth of 26%.

Organic Growth through Triveni Sugarcane Development Programme

Triveni’s sugarcane development programme is a key propeller of its socially and financially inclusive growth strategy. The Company continuously engages with the farmers to increase sugarcane productivity through its well-structured cane development programme. The dedicated team of sugarcane development staff works closely with the farmers, disseminating knowledge on the new technologies and innovations in the field of agriculture in general and sugarcane in particular.

The company has been working relentlessly on varietal development, yield improvement and crop protection. The structured varietal development programme has been instrumental in faster multiplication and commercial exploitation of high sugar varieties e.g. Co-0238 & Co-98014 and hence provide an edge over the peers.

The programme has helped in increasing productivity and farmers’ income while simultaneously elevating standard of living and social and educational status of 3 lakh plus farmers. The programme is also aimed at helping the Government in achieving the goal of doubling farmers’ income by 2022. Triveni’s focus during the year remained on the following key activities:

- Propagation of high sucrose varieties

- Increasing productivity through adoption of new technologies and better farm management practices

- Soil health sustenance and improvement through a structured comprehensive programme of soil testing and nutrient recommendations

- Better irrigation techniques and water conservation

Cumulatively, these continuous efforts have led to increase in recovery along with significant increase in sugarcane productivity leading to increased sugarcane crushing. With the increasing incidence of red rot reported in Co-0238 throughout Eastern UP and some parts of Central UP, the Company has initiated varietal replacement plan at all its sugar units. Besides focussing on propagation of tested varieties e.g. Co118, Co 98014, CoLk 94184, Co J85 (along with CoJ 88, an improved variety), new varieties e.g. Co 15023 & Co S13235, are being explored. Techniques such as single bud planting are being adopted for faster propagation of the varieties.

The Company is continuously working on yield improvement. Wide row-to-row spacing (specifically, trench technique & paired row technique) besides application of balanced dosage of fertilisers based on soil analysis reports are being propagated aggressively.

Since crop protection (protecting the standing crop from diseases & pests) is integral to the yield improvement endeavours, the Company is working aggressively on this aspect. It has specially incentivised availability of fungicides & pesticides for seed and soil treatment for the sugarcane farmers at all of its units.

The Company also persistently works on dissemination of knowledge on cropping methods for the overall growth of its farmers. They are being educated and persuaded to adopt new scientific and innovative techniques through a well-planned and structured extension programme, involving various digital and conventional tools.

Going forward, the Company believes that the sugar industry should explore potential applications of Artificial Intelligence (AI) in sugarcane production management, crop and soil health monitoring, predictive crop-analysis, while continually improving its existing smart and digital supply chain.

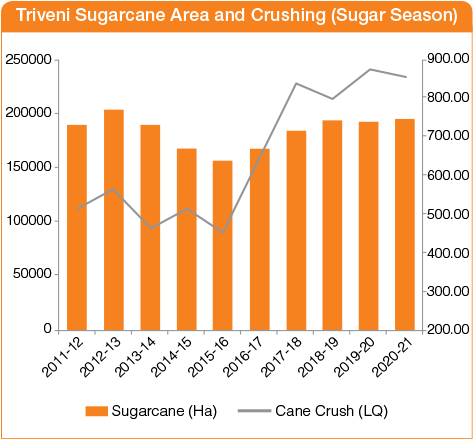

The area under sugarcane for the Company was marginally higher during SS 2020-21 as compared to SS 2019-20. However, the crushing reduced from 8.74 million tonnes in SS 2019-20 to 8.54 million tonnes in SS 2020-21 on account of climatic factors and red rot disease in certain regions.

The Company has consistently performed better in terms of recovery as compared to average UP state recovery.

The Company has achieved around 100% area under early and improved variety of sugarcane in SS 2020-21.

Market Outlook

The sugarcane area in states like Maharashtra & Karnataka has increased as well as crop yield in SS 2020-21. The SS 2020-21 is likely to close with a stock of less than 9.0 million tonnes which is sufficient to cater to the domestic consumption for more than 4 months. The growing diversion of sugarcane juice, B-heavy molasses and C molasses towards ethanol production is positive for the demand-supply in the market which should maintain the prices range-bound.

Initial estimates of SS 2021-22 indicate a production of around 31.09 million tonnes considering rise in sugar production in Maharashtra & Karnataka, as well as increased diversion of sugar to B-heavy molasses / sugarcane juice by around 3.4 million. Water levels in these states are at comfortable levels and it is predicted that the monsoon is expected to be normal.

The sugar supply is expected to be higher than the demand in the domestic market in SS 2021-22. It is imperative that the Government continues to pursue its policy on sugar exports and sugar mills need to aggressively push the ethanol production. India has one of the highest cane prices globally and accordingly, Indian sugar cannot compete effectively in the international market based on its resultant cost structure. Since the Government may not be able to offer export subsidies beyond 2023 due to WTO issues, there is an urgent need to address high cane prices and bring in necessary reforms by way of fixing cane price through Revenue Sharing Formula (RSF) and Price Stabilisation Fund (PSF). Accordingly, cane price should be fixed as a percentage of sugar revenues and the shortfall, if any, to be contributed by PSF, wherein funds would be contributed when the sugar prices are robust and are more than adequate to pay the cane price. Staggered payment of sugarcane price and increased focus on ethanol blending programme will go a long way to help the sugar sector and make it self-sufficient to operate on market forces with far less regulations and dependence on the Government. The Ethanol Blending Programme is the step in the right direction.

In the medium term, it is estimated that the prospects for the SS 2021-22 may be more balanced in the international market with a surplus of 1.7 million tonnes. Forecasts of ample rains and increase in sugarcane prices suggest a production recovery in Thailand during the next season to about 10.5 million tonnes. The consumption in the global market is expected to grow with little effect of the pandemic. If the oil prices continue to rule firm, the mix of sugar towards ethanol in Brazil may further improve, limiting sugar production for global supply. Considering these factors, the global market prices may remain range bound in medium term.

2021 Triveni Engineering, All Rights Reserved

Sugar Industry Review

Sugar Industry Review