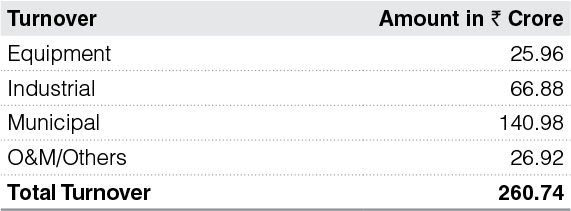

Water business was impacted during the year due to COVID-19 pandemic in terms of disruptions in project execution and delay in order finalisation. Despite such constraints, the Company has recorded annual turnover of ₹ 260.74 crore with a PBIT of ₹ 26.74 crore (on a consolidated basis) in its Water business during the year.

The Operation efficiency has improved during the year which is evident from indirect and administrative cost which remained under control.

Going forward, majority of investments are expected from the Central Government through NMCG and JICA, besides State funding from Karnataka, UP, Delhi, MP, Bihar, Jharkhand, Maharashtra and Rajasthan. WBG is well positioned to undertake more jobs in its chosen area of expertise. WBG has secured one package in Maldives towards the end of the year and actively looking to expand in foreign market; it will continue to evaluate opportunities in neighbouring countries on case-to-case basis.

Key Highlights

- Secured new Overseas EPC orders of Water & Sewerage projects worth USD 22.80 million (₹ 156 crore, net of GST) from Ministry of National Planning, Housing and Infrastructure, Republic of Maldives, funded by Exim Bank of India

- Secured Equipment Orders of ₹ 30.50 crore

- Achieved turnover of ₹ 260.74 crore in FY 21 and PBIT of ₹ 26.74 crore (on consolidated basis)

- Completed 40 MLD STP based upon SBR technology for BWSSB

- Completed 210 MLD ISPS project for BWSSB

- Regular participation in new bids have given a recognition in market

Water business was impacted during the year due to COVID-19 pandemic in terms of disruptions in project execution and delay in order finalisation. Despite such constraints, the Company has recorded annual turnover of ₹ 260.74 crore.

Market Outlook

Rapid urbanisation, combined with declining freshwater resources in the country, is expected to drive the adoption of innovative technologies and improvement of service delivery mechanisms. The private sector needs to play a larger role in driving this trend in innovation. While the Smart City Management is a big leap forward, certain measures need to be taken to ensure that it meets its purpose and targets. Equally important is the need to focus on mobilising new funding sources. ULBs also need to build financial and operational capacity.

The Outlook for FY 22 is positive and the Company sees potential business opportunities of approx. ₹ 4,000 crore through bids in first half of FY 22 including EPC and HAM projects. We expect that COVID-19 pandemic will subside in first half of FY 22 and normal business may start in second half of FY 22.

Hybrid Annuity Model (HAM) opportunities in Water Business

As we all are aware that Water is a State subject and is largely underfunded. There are several projects which are stalled due to lack of funds. The Company is in discussion with several Municipal Corporations / Water Boards to persuade them to implement projects on PPP / HAM basis with a view to generate business opportunities and to create a business niche for ourselves. The Company with its strong financials can invest in PPP / HAM concession projects and increase EPC opportunities. Apart from the State projects, many projects under the NMCG are also adopting the HAM route to finalise projects. The Company has submitted a number of bids under this programme and is also expecting many more opportunities to come in the current financial year. With good experience in the project at Mathura (HAM), the Company is well positioned to approach the market through this route and the learnings from the on-going project will help it to achieve success.

2021 Triveni Engineering, All Rights Reserved

Water Treatment Industry Review

Water Treatment Industry Review