The pandemic had the effect of pulling down business activities due to multiple factors, such as, suspension of business activities due to lockdown, subdued demand, distortion of supply chain, reduced labour availability, financial constraints, productivity issues due to health and social distancing norms, restrictions on travel to meet customers, pandemic-related constraints with customers to proceed with the project or take contractual deliveries. It was fortunate that our Sugar and Distillery operations remained largely insulated, being in the category of essential goods. However, in respect of the engineering business, there were issues relating to order booking / finalisation, supply chain and delays in taking delivery by customers but overall, the loss of business has not been significant.

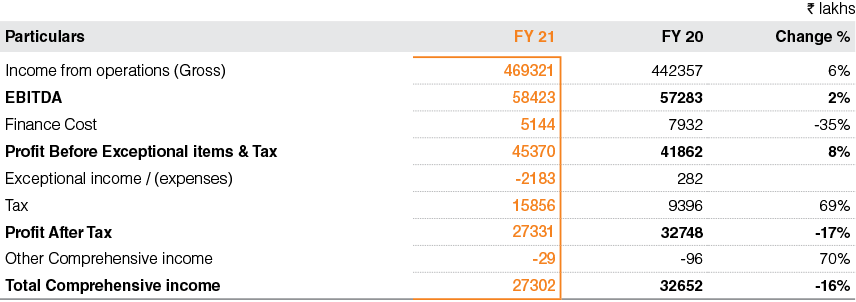

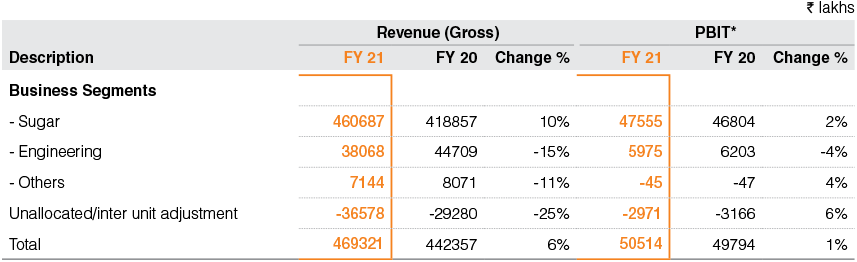

The Company has reported an increase in turnover by 6% and increase in PBT (Profit before Tax) before exceptional items by 8% in the current year. Sugar business (including Distillery & Cogeneration operations) has posted 10% increase in turnover with 2% increase in Segment Profits (Profit before Interest and Tax – PBIT) while the turnover of the Engineering Business is lower by 15% with reduction in Segment Profits by 4%. The performance of engineering business was impacted by COVID-19 related issues, which resulted in delayed order finalisation, slow progress in few jobs as well as deferment of few jobs / deliveries to the next financial year.

Finance cost during the year is 35% lower than the previous year, despite lower buffer stock subsidies by ₹ 17.93 crore, mainly due to lower utilisation of term loans by 13%, working capital by 56% and lower cost of funds. The lower utilisation of working capital has resulted from better inventory management and realisation of large amount of subsidies receivable from the Government.

Exceptional items comprise an impairment charge in respect of equity investment in the associate Company, Aqwise Wise Water Technologies Ltd (“Aqwise”). The Company signed a Share Purchase Agreement dated March 25, 2021 for divesting its stake in Aqwise and accordingly, based upon estimated consideration to be received, an impairment loss of ₹ 23.20 crore was recognised.

During the year, tax incidence and effective tax rate were higher than the previous year as in the previous year, deferred tax charge was lower by ₹ 40.60 crore due to remeasurement of deferred tax liability (net) which is expected to reverse in the future when the Company would have shifted to the new tax regime pursuant to Section 115BAA of the Income Tax Act, 1961. In view of high tax incidence, profit after tax is 17% lower at ₹ 273.31 crore. As the Company has exhausted all MAT credit and certain exemptions/deductions, it may be subject to lower tax rates under new tax regime for the subsequent periods.

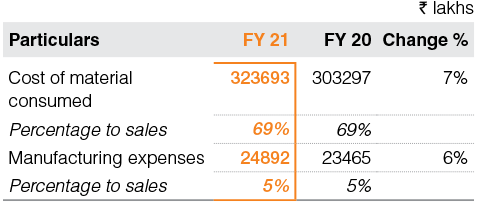

Raw Material and Manufacturing Expenses

Raw Material costs have increased by 7% commensurate with increase in sugarcane crush by 8%. Raw material cost for FY 20 is net of production subsidy/export incentive (@ ₹13.88/quintal pertaining to cane crush in April/May’2020 forming part of sugar season 2018-19) of ₹ 24.27 crore. Raw material percentage to sales may not be very indicative in sugar business as raw material consumption is directly linked to the sugarcane crush and production of sugar and not sale of sugar.

Manufacturing expenses have increased by 6% mainly due to higher cane crush by 8%, higher production in distillery by 14%. In sugar business as well as in distillery, such costs are directly linked to the production rather than to the sales.

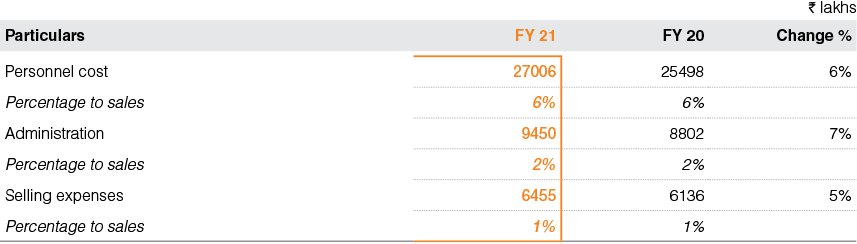

Personnel Cost, Administration Expenses and Selling expenses

The increase in personnel cost is due to normal annual salary increase. The increase in Administrative expenses is mainly because of increased activity, including full year operations of the new distillery and certain non-recurring expenses pertaining to discarding of fixed assets of ₹ 3.61 crores necessitated due to installation of an incineration boiler at old distillery at Muzaffarnagar. Selling expenses are higher due to increased sales volumes in distillery as reduced by savings in transportation costs relating to lower sugar exports.

Segment Analysis

*Before exceptional items

The Company has two major business segments - Sugar business and Engineering Business. Sugar business comprises sugar manufacturing operations across 7 Sugar mills, 3 Cogeneration plants located at two of its Sugar mills, 03 incidental cogeneration facilities at three of its sugar mills and two Distillery units, all located in the State of U.P. Cogeneration plants and Distillery units source captive raw materials, namely, bagasse and molasses respectively, from the sugar mills. Engineering business comprises of Power Transmission manufacturing facilities at Mysore and Water and Waste Water Treatment business operating from Noida, UP.

Sugar Business Segments

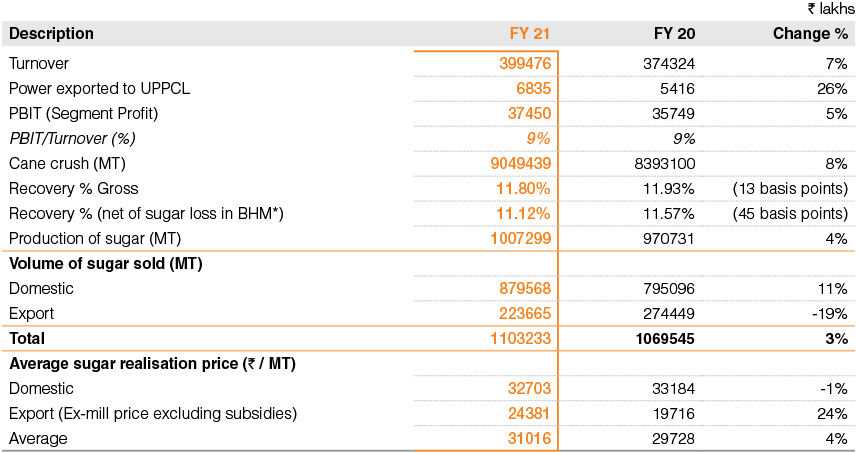

Sugar Operations

(*) B- heavy molasses

There was a general trend of lower yields and recovery in the SS 2020-21 in Uttar Pradesh but the Company has fared much better and the decline in crush and recovery in the SS 2020-21 is much lower than the decline in the average of the state of Uttar Pradesh.

Segment profit during the year has increased by 5% despite the fact that previous year was benefitted by higher export subsidy of ₹ 35.57 crores pertaining to FY 2018-19. The increase in the segment profit is attributed to higher sugar dispatches and improved margins, particularly in exports. In respect of exports made during the year, subsidies of ₹ 57 crore (Previous year - ₹ 57.66 crores) could not be booked pending fulfilment of the prescribed conditions and the same will be recognized subsequently on completion/fulfilment of relevant conditions.

During the year, the cogeneration operations have been merged with the sugar operations and the cogeneration activities no longer qualify as a separate operating segment. Accordingly, these have been combined with the sugar segment in accordance with Ind AS 108 ‘Operating Segments’ and the figures of the previous year / periods have been regrouped.

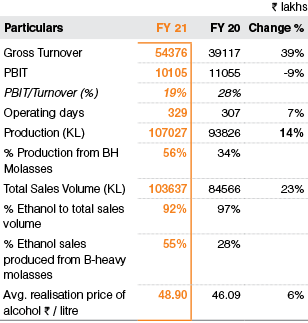

Distillery Operations

The turnover in Distillery operations is substantially higher than the previous year on account of full year impact of the new distillery which was set up in the previous year at Sabitgarh and also due to higher operational days due to installation of incineration boiler at Muzaffarnagar. Consequently, the production has increased by 14% during the year and sales volume by 23%. Segment profits are, however, lower by 9% due to increased cost of molasses and due to certain non-recurring expenses relating to discarding of fixed assets upon installation of incineration boiler at the old distillery at Muzaffarnagar.

Currently, the distillation capacity is 320 KLPD, and the Company is proposing to set up a dual feed 160 KLPD distillery at our sugar unit at Milak Narayanpur and another 40 KLPD grain-based distillery in our existing distillery complex at Muzaffarnagar. Both these distilleries are expected to be set up by the end of Q4 FY 22, and the total installed capacity would increase from 320 KLPD to 520 KLPD. Further, in view of the proposed expansion plans, the installed capacity would increase to 660 KLPD by the commencement of SS 2022-23.

The Company has been progressively increasing its distillation capacity to improve risk profile of its businesses and to reduce dependence on the cyclical sugar business. Further, as a forward integration and to effectively use reserved molasses, which are required to be sold to IMIL units at almost 1/4th of the market price of the C-Heavy molasses, the Company has set up a bottling plant to manufacture IMIL during the year.

Engineering Business Segment

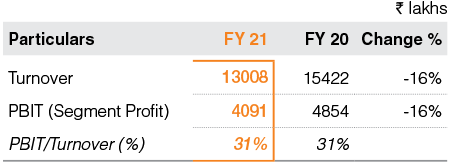

Power Transmission Business (PTB)

As a result of Covid-19 related issues and constraints, capital goods industry was impacted and there was a slowdown in new investments as well as expansion projects. It resulted in delayed order finalisation, reduced order intake and deferment of deliveries. Despite the aforesaid constraints, PTB business has done reasonably well with total exports increasing from 11% of the turnover in the previous year to 18% in the current year.

The Company is exploring new products, geographies and actively engaged with the Defence Sector to tap business opportunities for further growth and diversification. The Government of India’s ‘Make in India’ initiative has led to new opportunities for diverse engineered products, and PTB’s Mysuru facility is actively participating in many of these indigenous development projects. PTB is initially focussing on Naval Defence markets and has gained some foothold in the critical turbo pumps space.

Orders of ₹ 157.76 crore were received during the year. The outstanding order book as on March 31, 2021 stood at ₹ 166.23 crore including orders of ₹ 66.23 crore executable over a couple of years

Water and Wastewater Treatment Business

The consolidated results include financial results of a wholly-owned subsidiary, Mathura Wastewater Management Private Limited (MWMPL), which is engaged in the execution of a project awarded by National Mission of Clean Ganga (NMCG) under Namami Gange programme for the city of Mathura, UP.

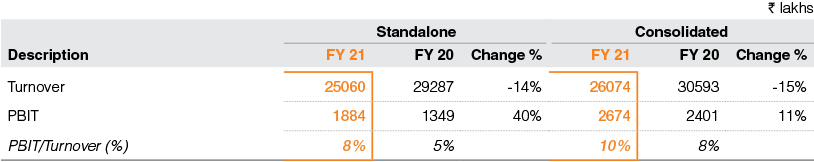

The turnover of WBG has declined by 14% to ₹ 250.60 crore but its segment profit has increased by 40% to ₹ 18.84 crore. Increase in profitability is due to efficient project execution which has led to overall cost savings.

The business operations of water business were impacted due to COVID-19 which had caused interruptions in the operations, including due to shortage of labour, and delay in finalization of orders.

During the year, orders of ₹ 186.50 crore were received by the Company. The finalisation of several projects was delayed due to various disruptions. Orders in hand at the yearend are at ₹ 912.02 crore (including long term O&M contracts of ₹ 456.87 crore).

Water business has during the year secured an EPC project of Water Sewerage project of US$ 22.80 million (₹ 156 crores) from Ministry of National Planning Housing & Infrastructure of Republic of Maldives funded by Exim Bank of India. WBG has a strong order pipeline and visibility of other projects to be tendered during the year, including projects on Hybrid Annuity Model in the municipal as well as private sector.

Review of Balance Sheet

Major changes in the Balance Sheet items are explained as hereunder:

Non-Current Assets

Property Plant and equipment

During the year, there have been additions to the extent of ₹ 69.01 crore. Additions of ₹ 28.73 crore have taken place in the Distillery segment, including a new bottling plant for alcoholic beverages and balance capitalisation of incineration boiler at Muzaffarnagar. The additions of ₹ 35.71 crore has taken place in the Sugar business.

Capital work-in-progress

The Capital work in progress of ₹ 22.23 crores mainly comprises construction of sugar godown at Sabitgarh, and expenditure relating to new distilleries which are in the process of being commissioned.

Investments in subsidiaries and Associates

Investments are lower at ₹ 41.95 crores as on 31.3.2021 as compared to ₹ 69.77 crores as on 31.3.2020 as investments of ₹ 30.06 crores in the associate company, Aqwise Wise Water Technologies Ltd (“Aqwise”), has been considered as “Assets held for sale” consequent to a Share Purchase Agreement signed for divestment of the equity stake held in Aqwise.

Income tax Assets (net)

The income tax assets (net) represents amount receivable upon completion of the assessment and against various appeals decided in favour of the Company, the refund procedures of which are in progress. During the year, refunds of ₹ 31.20 crore were received.

Current Assets

Inventories

Inventories are lower by 9% at ₹ 1733.75 crore as on March 31, 2021 due to 17% lower sugar inventories held in quantitative terms. Reduced inventory levels are a result of higher sugar sales volumes (including exports), lower opening sugar inventory by 15% and diversion of higher sugar to B-heavy molasses.

Trade Receivables

Trade receivables are lower at ₹ 220.63 crore as on 31.03.2021 from ₹ 295.32 crore as on 31.3.2020. The receivables have reduced in Sugar and Co-generation by ₹ 36.24 crore and in Water business by ₹ 52.49 crore.

Other Current Assets

It has reduced to ₹ 269.35 crore as on March 31, 2021 from ₹ 437.54 crore as on March 31, 2020, mainly due to receipt of substantial amount of subsidies during the year – subsidies receivable from the Government have significantly reduced to ₹ 45.36 crore as on 31.03.2021 as compared to ₹ 235.14 crore receivable as on 31.03.2020. It further includes customer retention of ₹ 106.83 crore pertaining mainly to Water Business.

Equity

Share Capital

The Company had during the year successfully completed buyback of 61.90 lakhs fully paid-up equity share and the share capital has reduced correspondingly.

Other Equity

During the year, the reserves and surplus increased by ₹ 193.20 crore (16%) to ₹ 1439.06 crore due to profit earned during the year and transferred to Retained Earnings, as reduced by premium of ₹ 64.38 crore paid on buyback of shares and expenses of ₹ 15.44 crore incurred in connection with such buy-back.

Term Borrowings (Non-current & Current)

Total long-term borrowings at the year-end, including current maturities of long-term borrowings, are at ₹ 382.09 crore as against ₹ 614.72 crore as at the end of the previous year. During the year, term loan repayments were made to the extent of ₹ 238.56 crore including prepayment of a term loan of ₹ 125 crore after the expiry of the interest subvention period. Almost all outstanding Term loans are at concessional interest rate or carry substantial interest subvention.

Current Liabilities

Borrowings

Short term borrowings are lower at ₹ 561.57 crore as on 31.03.2021 as against ₹ 943.44 crore as on March 31, 2020. The utilisation is lower due to better working capital management resulting in lower sugar inventory held at the yearend as well as surplus funds parked in the cash credit account.

Trade Payables

Trade payables are lower at ₹ 624.13 crore as on March 31, 2021 as against ₹ 756.40 crore as on 31.03.2020. It comprises cane dues of ₹ 520.07 crore as on 31.03.2021 as against ₹ 607.31 crore as on 31.03.2020.

Other Financial liabilities

Other Financial liabilities are lower at ₹ 155.40 crore as on March 31, 2021 as against ₹ 200.79 crore as on March 31, 2020. The decrease is mainly owing to decrease in current maturities of long-term loans by ₹ 38.47 crore

Other Current liabilities

Other Current liabilities are higher at ₹ 164.26 crore as on March 31, 2021 as against ₹ 153.56 crore as on March 31, 2020. It includes liability of ₹ 80.76 crore to customers under construction contracts for Water Business in view of higher billing than revenue recognised based on work completion.

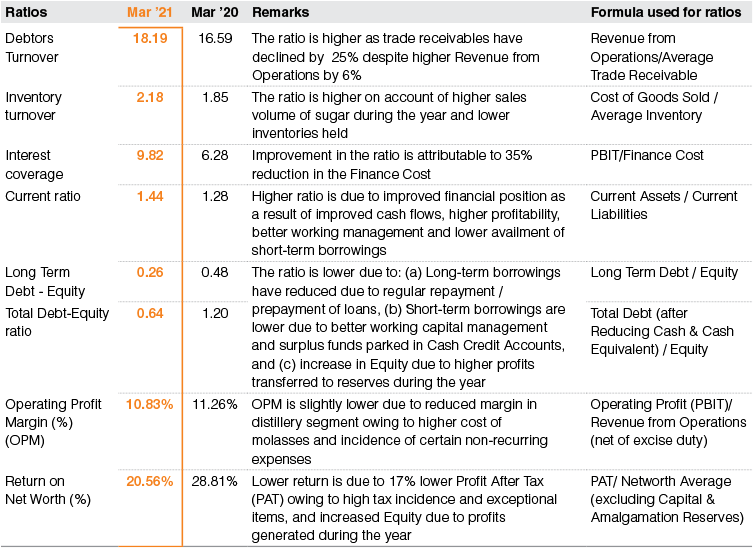

Key Financial Ratios

2021 Triveni Engineering, All Rights Reserved

Water Treatment Business Performance

Water Treatment Business Performance